- A mortgage processor is a switch elite group on the mortgage financing procedure.

- They play the role of a good liaison involving the financing officer, underwriter, and you will debtor.

- Mortgage processors have the effect of gathering and you will tossing loan application data files.

- They be sure the fresh completeness and you will reliability of one’s mortgage file in advance of underwriting.

- Processors play a crucial role within the making sure compliance which have credit laws and regulations.

- The things they’re doing is important to own a flaccid and successful financial approval process.

- Determining the new borrower’s credit history is key, as it includes checking to possess discrepancies and evaluating percentage habits so you can have a look at creditworthiness, which certainly impacts financial recognition opportunity.

Introduction

Once you apply for home financing, multiple masters performs behind the scenes to make their homeownership goals to the facts. One of the most extremely important but really commonly overlooked spots in this processes is that of the mortgage loan processor. Home loan officers and you can real estate loan originators plus play trick opportunities, guaranteeing clear communication and you can information that have processors and you may underwriters to navigate the complexities of having financing. As a talented financial professional, I’ve seen personal just how essential mortgage processors are to the loan community. Contained in this publication, we’ll explore exactly what a mortgage chip do, why their role is really crucial, and how they contribute to your property to invest in travel.

Knowing the Mortgage Chip Part

An interest rate processor is a financial elite which performs a good pivotal part regarding mortgage credit processes. They act as the fresh new link between your mortgage administrator, just who functions directly on the debtor, while the underwriter, exactly who helps to make the final choice on loan recognition. Researching the brand new borrower’s credit rating is vital on financing acceptance process, because it facilitate assess the person’s early in the day borrowing from the bank performance and you may risk height. The latest processor’s number one duty should be to prepare the mortgage declare underwriting of the ensuring all of the expected installment loans online Maine paperwork is obtainable, perfect, and you will certified that have financing requirements.

Tips for Very early Homeloan payment

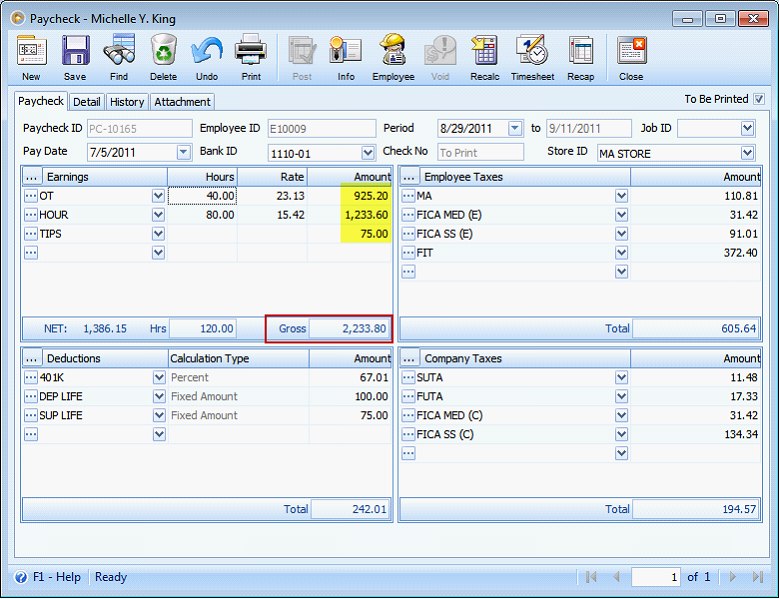

- Proof of earnings (W-2s, pay stubs, tax statements)

- Bank comments

The significance of Mortgage loan Processors

Real estate loan processing are reveal process that pertains to several levels and you may elements, focusing on the chance of mistakes in addition to importance of conformity having regulatory requirements.

Enjoy and you may Official certification

Of several processors has bachelor’s degree in loans, providers, or associated industries, even in the event it’s not always called for. Skills, including the Specialized Home loan Processor (CMP) designation, can raise a good processor’s credentials and you may assistance.

Prominent Misunderstandings

Reality: Mortgage officials works yourself with clients so you’re able to originate financing, if you’re processors run planning the borrowed funds apply for underwriting. Home mortgage officers are registered experts who come together closely which have processors to be certain a smooth mortgage lending processes.

Exactly how DSLD Home loan Utilizes Competent Processors

All of our operations particularly work at mortgage loans, ensuring that we are well-capable of handling every aspect of financial financing process.

Conclusion: The latest Unsung Heroes out-of Home loan Financing

Mortgage processors usually are new unsung heroes of one’s financing world. Their meticulous really works behind-the-scenes is very important having flipping the home loan app towards an approved mortgage. From the making sure accuracy, compliance, and completeness of the financing file, processors play a vital role in helping you accomplish their homeownership requirements. Financial processors are very important in organizing papers, verifying borrower advice, and making certain most of the expected data is done just before submitting into home loan underwriter.

Knowing the role away from an interest rate processor helps you delight in the reasons of home loan financing techniques as well as the importance off delivering comprehensive and you may exact recommendations whenever obtaining a loan. Moreover it shows why opting for a lender having skilled and you will knowledgeable processors, like DSLD Mortgage, produces a difference of your property to purchase trip.

If you’re considering making an application for a home loan and now have questions relating to the process or perhaps the jobs of several positives inside, please contact united states on DSLD Home loan. All of us regarding experienced mortgage officials and you may processors is here now in order to assist you courtesy every step of one’s mortgage app techniques, making sure a smooth road to homeownership.

Think about, although you may well not interact actually with your financing chip, the diligent tasks are a critical role from inside the turning your own homeownership fantasies on the reality. During the DSLD Mortgage, we’re dedicated to leverage the expertise of our very own processors and all of we professionals to provide you with the finest home loan experience.

Leave a Comment